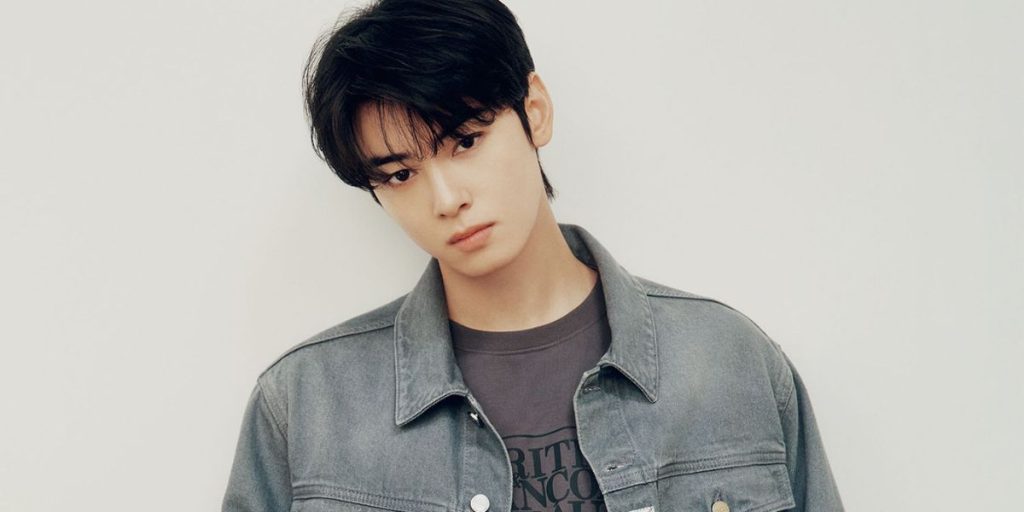

ASTRO member and actor Cha Eun-woo has become the focus of a major tax controversy in South Korea. On Saturday, January 24, a reputable Korean media outlet, Dispatch, released an investigative report on the hot topic.

The National Tax Service (NTS) has reportedly demanded more than ₩20 billion KRW ($13.6m) in additional taxes. They alleged that Cha and his family used a series of family-run companies to improperly reduce his tax burden. The case is currently under dispute and has not yet been finalized.

The controversy centers on a company called Chas Gallery, which was established in July 2019 in Anyang, Gyeonggi Province. At the time, Cha Eunwoo was listed as the CEO, while his mother served as an inside director and his father as an auditor.

The company registered an unusually wide range of business purposes. This included artist management, record production, advertising, event planning, IP management, cosmetics, restaurants, and even theme parks.

Over the next few years, Chas Gallery repeatedly changed its address, moving from Anyang to Gimpo, and later to Ganghwa Island. The final registered address was an eel restaurant operated by Cha Eunwoo’s parents. In September 2020, his mother officially took over as CEO.

In 2022, a new limited liability company called LNC was founded by Cha’s mother. Although the company name changed, its business purpose remained largely the same, which was focusing on management activities. Around the same time, the ASTRO member renewed his exclusive contract with Fantagio, reportedly receiving one of the largest signing bonuses ever given to an idol.

Two years later, in 2024, yet another entity, D.A.N.E. was established. This company was reportedly responsible for managing Cha Eunwoo’s assets, including real estate. Like LNC, it was registered as a limited liability company and shared the same address as the family’s restaurant on Ganghwa Island. That same year, Chas Gallery effectively ceased operations and was left as an empty shell.

According to Dispatch, the National Tax Service views this sequence of company creations and restructurings as suspicious. Investigators argue that while the companies were legally registered, they may have functioned as “paper companies.”

This means they were created primarily to reclassify Cha Eunwoo’s personal income as corporate income. In South Korea, the top personal income tax rate reaches nearly 49.5 percent, and the effective corporate tax rate is closer to 26 percent. By channeling income through a corporation, a high-earning individual could significantly reduce their tax obligations.

The NTS estimates that the unpaid tax amount exceeds ₩20 billion, which would imply taxable profits of at least ₩100 billion over several years. Authorities argue that the limited liability company structure allowed the family businesses to operate without external audits or public disclosure. This makes it easier to move assets, purchase real estate, and deduct expenses without sufficient transparency.

Dispatch also points to the fact that key decisions within these companies were reportedly made only by close family members, Cha’s parents and sibling.

Dispatch also links the formation of these companies to instability within Cha Eunwoo’s agency, Fantagio. In 2016, Fantagio faced capital erosion and management disputes after CEO Na Byung Jun brought in Chinese investors. Control of the company eventually shifted to Chinese shareholders, and the original CEO was forced out.

In 2019 — the same year Chas Gallery was founded — Fantagio’s major Chinese shareholder, JC Group, was reportedly facing bankruptcy. Its head was allegedly arrested in China for illegal fundraising and fraud. Dispatch suggests that this uncertainty may have led Cha Eunwoo to consider building a separate business structure for financial and career protection.

However, the situation is further complicated by the fact that the idol-actor renewed his contract with Fantagio in 2022, after “Market tycoon” Chairman Namgoong Gyeon acquired the company. Reports state that Cha received the highest signing bonus ever for an idol at the time.

Despite this, the family established two companies, when Cha Eunwoo was operating as Fantagio’s flagship artist. Fantagio has strongly denied any wrongdoing and says that the issue is a difference in legal interpretation.

Legal experts explain that the key issue is whether these companies provided actual services. Even if a company is legally registered, it can still be considered a paper company for tax purposes if it exists only to disguise personal income. If the NTS proves deliberate deception, the case could move beyond tax penalties into criminal liability. If not, it may remain a civil tax dispute involving back payments and fines.

Cha Eunwoo, who enlisted in the military in July 2025, has not made a personal public statement regarding the investigation.