HYBE Corporation is now under intense scrutiny as South Korea’s National Tax Service (NTS) has launched a special tax investigation into the company.

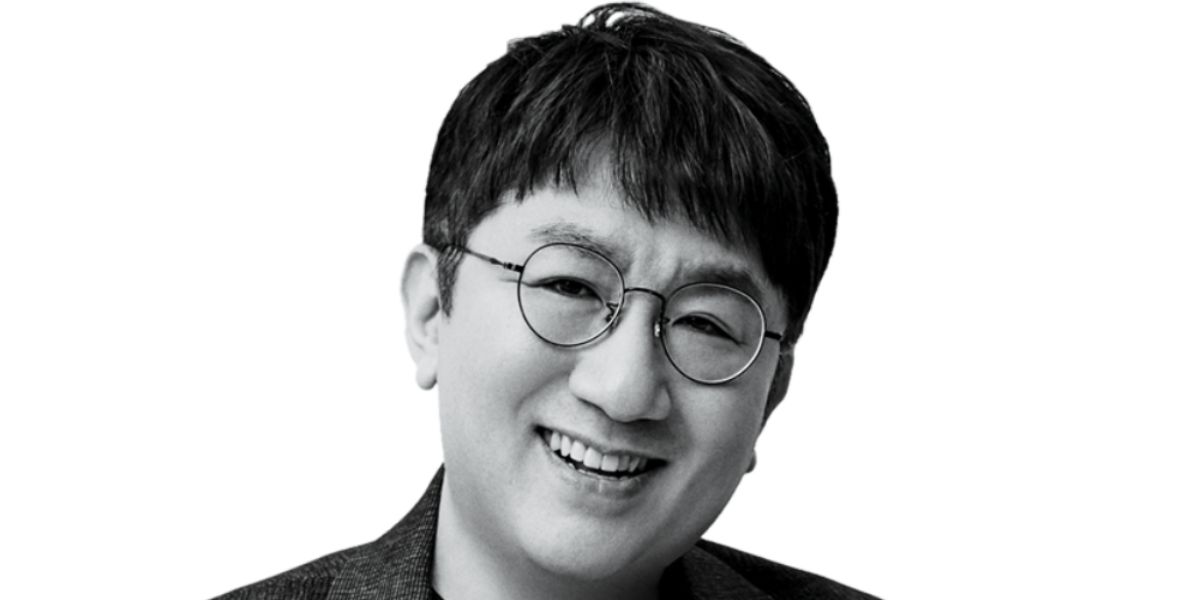

The probe follows growing allegations of stock-related misconduct involving Chairman Bang Si Hyuk and former executives.

On July 29, the Seoul Regional Tax Office’s 4th Investigation Bureau dispatched officials to HYBE’s HQ in Yongsan-gu, Seoul. The team secured financial documents and internal records as part of an irregular tax audit.

HYBE is among 27 companies and individuals named by the NTS in its crackdown on what it calls “unfair tax evasion in the stock market.”

This investigation comes shortly after South Korea’s Securities and Futures Commission (SFC) referred Bang Si Hyuk and former HYBE executives to the prosecution on charges of violating Article 178 of the Capital Markets Act, which prohibits unfair trading.

The case centers around HYBE’s 2020 IPO. Investigators allege that Bang and others misled existing shareholders by suggesting a delay in the company’s listing.

During that time, they reportedly bought shares from early investors at reduced prices—only to sell them for large profits after the company went public. He is also suspected of selling his shares to a special purpose company (SPC) connected to a private equity fund formed by former HYBE executives.

A profit-sharing agreement allegedly gave Bang Si Hyuk 30% of proceeds from those sales. However, the agreement and links between the SPC and HYBE insiders were reportedly concealed during the IPO process

Adding to the mounting pressure, HYBE’s offices were raided on July 24 by the Financial Crimes Investigation Unit of the Seoul Metropolitan Police, following the SFC’s complaint..

This latest tax probe is part of a broader government crackdown on practices that harm minority shareholders. The NTS says it will investigate various forms of market abuse, including stock price manipulation through false disclosures, the misuse of corporate assets by “raiders,” and power abuse by majority shareholders.

Authorities are expected to examine whether HYBE evaded taxes on overseas earnings, manipulated transfer pricing, or mishandled the tax treatment of affiliated artists. Internal transactions between HYBE and its related entities are also under review.

While a National Tax Service spokesperson declined to disclose specific details, another official confirmed

This irregular tax investigation will not solely focus on unfair trading practices in the stock market by major shareholders or high-level executives. It is highly likely that a wide-ranging investigation will be conducted, including whether there was tax evasion involving profits generated by local subsidiaries in the U.S., Japan, and Southeast Asia (such as offshore tax evasion and transfer pricing manipulation), the appropriateness of tax handling for affiliated artists, and the nature of internal transactions between related parties and affiliates.

The outcome of this investigation could have serious implications for HYBE’s leadership and its reputation. As one of K-pop’s most powerful companies, its legal and tax troubles are grabbing considerable public and industry attention.