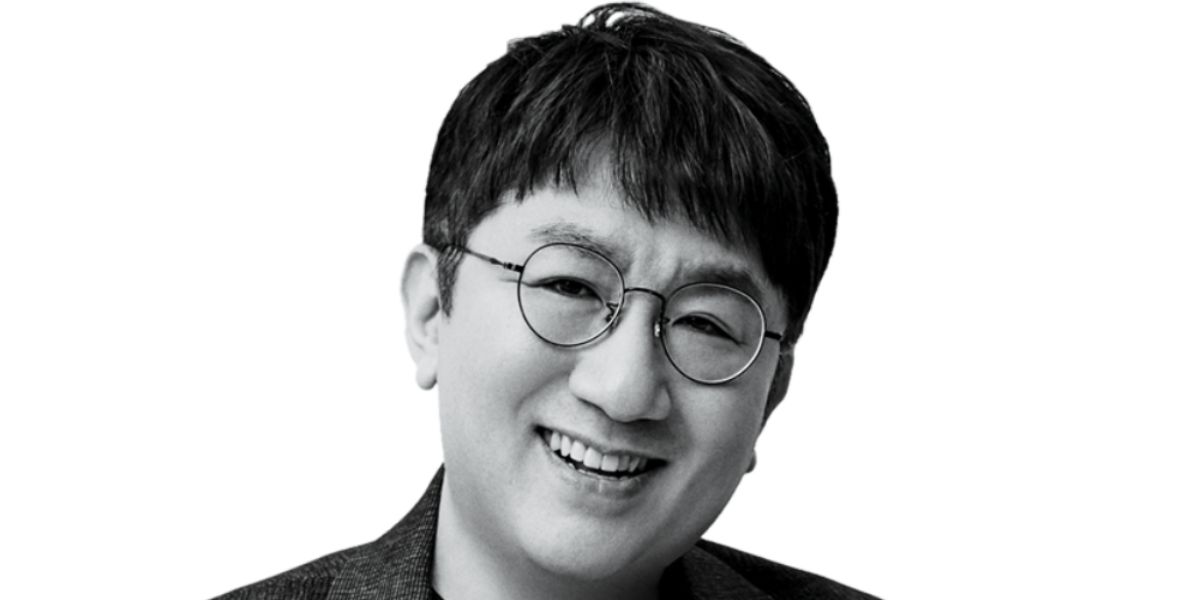

Bang Si Hyuk, the chairman of HYBE, the company behind global superstars BTS, is facing some serious accusations. South Korea’s financial watchdog, the Financial Supervisory Service (FSS), is looking into whether he cheated during HYBE’s stock market debut (IPO) a few years ago.

On May 28, Korea Economic Daily reported that they intend to request prosecution to investigate Bang for alleged fraudulent and unfair trading.

As per the report, FSS has secured solid evidence that in 2019, he told existing investors that HYBE had “no plans for an IPO.” But at the same time, he allegedly sold his own shares to a special investment fund PEF, managed by someone he knew.

While he told shareholders there was no plan to go public, it is believed Bang Si Hyuk was actually planning the IPO. The FSS says HYBE signed with Hanyoung Accounting Corporation for a special audit in November 2019, which is a required step before a company can go public.

When applying for a designated auditor, they presented documents indicating plans for a listing, such as agreements with lead managers or board resolutions. However, in communications with existing investors, they conveyed a different story, stating that they had no plans for a listing.

The eyebrow-raising part is that Bang Si Hyuk supposedly had a secret deal with this investment fund. He was set to get 30% of their profits from the investment, and he reportedly pocketed around 400 billion won ($291 million). This contract was never mentioned in the official papers when HYBE went public.

The Financial Supervisory Service has deemed Hive’s listing events as fraudulent and unfair under the Capital Market Act, planning to swiftly report them to prosecutors. The Seoul police are also probing the case.

HYBE, on the other hand, says that everything they did was legal and reviewed by lawyers. An official claims, “All transactions were conducted within legal boundaries after thorough legal review.”

If Bang Si Hyuk is found guilty, he could face a very harsh penalty. According to the Capital Market Act’s Article 443, if illegal gains surpass 5 billion won, the sentence can be life imprisonment or at least 5 years in prison.

Financial authorities are reportedly planning a tough response, considering the case’s broader impact and symbolic significance in the capital market.