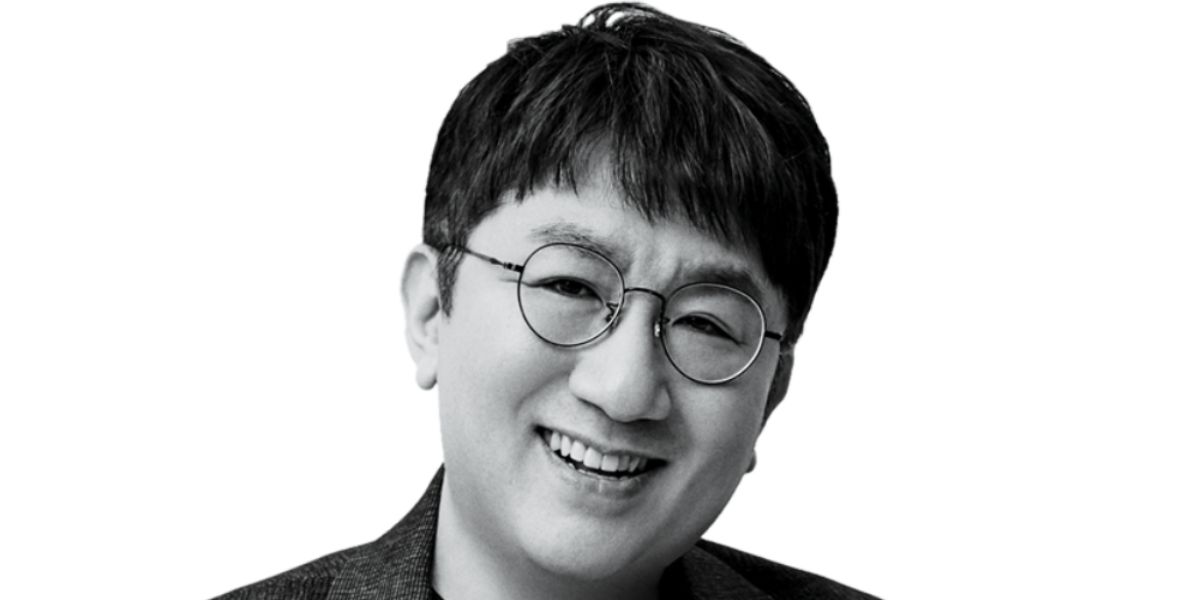

Prosecutors have rejected a second police request to search HYBE’s headquarters as part of an investigation into Bang Si Hyuk. The HYBR chairman is under investigation for allegations that Bang misled shareholders in a $293 million deal.

Police sought a warrant to raid HYBE’s offices, claiming they needed further evidence in their fraud investigation. However, prosecutors denied the request—for the second time—without providing detailed reasons. Legal experts suggest this could mean police lack sufficient grounds or that prosecutors want more concrete evidence before approving such a high-profile search.

For the second time, the Seoul Southern District Prosecutors’ Office has denied a police request for a search warrant targeting HYBE headquarters as part of their investigation into Chairman Bang Si Hyuk.

According to the Korea Economic Daily, prosecutors rejected the latest warrant application filed by the Seoul Metropolitan Police Agency, which is probing alleged violations of market laws by Bang.

This follows an earlier rejection on April 30, after which police conducted additional investigations before resubmitting their request. Despite the second denial, authorities reportedly plan to file a third warrant application.

The Korea Economic Daily reported that the Financial Supervisory Service (FSS) has uncovered evidence suggesting Bang Si Hyuk may have misled early investors back in 2019, before the company’s public listing.

Investigators allege he convinced shareholders to sell their stakes to a private equity firm founded by an acquaintance. Bang did not disclose that he received a 30% commission from the deal.

According to documents obtained by the FSS, he reportedly collected 400 billion won ($293 million) after HYBE’s successful IPO – money that never appeared in the company’s official securities filings.

The investigation centers on whether Bang violated capital market laws by allegedly telling investors an IPO wasn’t being considered. While he withheld information from shareholders, his team was actively preparing listing documents and securing audit certifications.

Several investors claim they sold their shares based on these representations, only to see HYBE go public shortly afterward.

The FSS is now examining whether these actions constitute securities fraud since the HYBE Chairman did not disclose his deal with the acquiring firm. If proven, he could face a substantial fine or life imprisonment.